Healthcare deals are (sort of) back: What healthcare investment in 2025 tells us about the broader healthcare market

- Jordan Peterson

- 14 minutes ago

- 8 min read

After a couple of uneven years, healthcare dealmaking came back to life in 2025. By most measures, both deal volume and value are trending upward again—though still off the torrid pace of 2021, when cheap capital and a post‑pandemic spending spree sent valuations through the roof.

At Union, we tend to read deal activity as one of the better directional cues for where healthcare is headed. When capital flows change course, market strategy usually isn’t far behind. And while the rebound is real, the tone of the market feels different this time around—less speculative, more disciplined.

In this blog post, we’ll cover:

A reminder about what healthcare deal activity has looked like over the past couple of years.

Three signals that shaped healthcare investment in 2025.

What’s next for healthcare investment in 2026.

Topline story: Healthcare investment in 2025 was up—with more guard rails

Before we get into deal activity in 2025, it’s helpful to start with a little bit of context. As a reminder, 2024 was a mixed bag from an investment perspective. Deal volume continued to decline from the high reached in 2021 but was still very much elevated from the pre-pandemic norm. This was to be expected—healthcare deal volume was unusually high post‑pandemic because of cheap and abundant capital and high investor appetite for scalable healthcare platforms. Naturally, the unusually high value fell as interest rates rose, margins came under pressure, and regulatory uncertainty increased.

But now it looks like healthcare deal value is on the rebound, as both value and volume picked up again in 2025—still not reaching the 2021 high, but surpassing the last three years. That being said, activity was uneven across the year. Momentum was slow in the second quarter amid policy shifts, trade tensions, and tariff uncertainty. However, the year finished off strong, with activity picking back up in the second half of the year.

Let’s start with the momentum behind the numbers. Two tailwinds drove 2025’s rebound: plentiful dry powder and aging portfolio companies nearing their planned exits.

High levels of dry powder: There are a couple of reasons why PE firms had so much un-deployed capital (i.e. dry powder) in 2025. First, PE funds went through a major fundraising boom in 2020 and 2021. But then deployment slowed during the market uncertainty of 2022 and 2023, which left record amounts of unspent capital heading into last year. At that same time, strategic exits have slowed since 2022, meaning PE firms were left holding portfolio companies longer (we’ll dive into this later in the blog post), which keeps funds open with more un-deployed capital.

A growing cohort of sponsor-owned assets reaching the end of their fund lives: With strategic exits slowing, there are a rising number of PE‑owned healthcare businesses—everything from PE-backed physician groups to software platforms—approaching the end of their investment cycles, prompting a wave of sale processes and recapitalizations.

The result? 2025 investment activity looked busy again and, with these trends acting as tailwinds, it’s likely 2026 will be an active year. However, from where we stand today, we expect it will look slightly different than the high we saw in 2021. Here’s why we think that’s the case:

2021 was largely seen as year of “growth at any cost.” In 2021, investors aggressively funded many types of healthcare assets, including early stage or unprofitable digital health platforms with still unproven business models.

With lessons learned coming out of the 2021 investment boom, compounded by increased regulatory scrutiny of PE in healthcare—particularly around consolidation—2026 may shape up to be the year of “cautious optimism” where investors place greater emphasis on deals that avoid regulatory exposure and show consistent performance.

Let’s take a deeper look into how this shift is already playing out.

Signal 1: Digital health funding picks up, fueled by AI

Let’s start with the area where we saw the most activity. Across 2025, there was a clear stand out performer: digital health. Most people already know that the massive mid-pandemic spike in digital health funding was followed by a huge industry shakeout as funding declined in subsequent years. We saw a slight bounce back in 2024—not at the previous high of funding but increasing as investors sought digital tools to manage costs and improve efficiency.

The reset of funding continued in 2025—fueled by artificial intelligence. In 2025, annual funding for U.S. digital health startups reached $14.2B (a 35% increase over 2024)—the highest total since 2022.

But there are two different stories playing out simultaneously. On one hand, funding was up in 2025. But fewer companies appear to be capturing this capital. We saw 482 deals across 2025, compared to 509 deals in 2024. Despite the apparent drop in deals from 2024 to 2025, the share of mega deals (raises over $100 million) represented a much higher proportion of dealmaking in 2025.

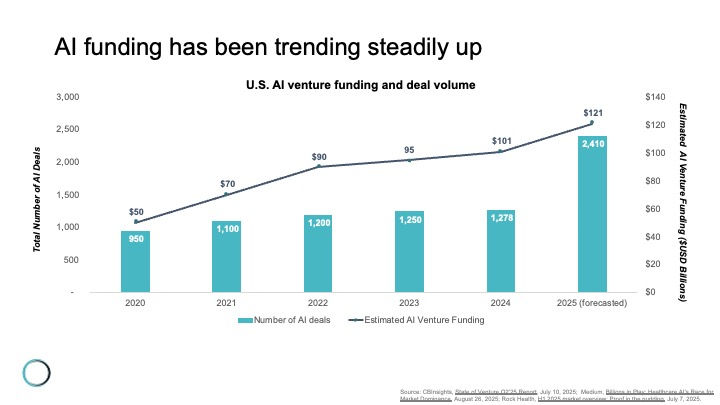

A big part of that story is investment frenzy around AI, which is driving much of the digital health activity. Across 2025, 50% of deals were closed by “AI-enabled” companies, capturing 54% of total funding (up from 37% in 2024). This AI-crazed investment isn’t isolated to healthcare either—it’s widespread across all venture funding as you can see in the chart below, which highlights dealmaking across all industries (meaning the data is not specific to healthcare). It’s clear that investment is going steeply up, with total funding reaching $121 billion in 2025, a nearly 20% increase from 2024.

What’s next?

There’s a lot of discussion in the media at present about whether we are looking at an AI investment bubble—both inside and outside of healthcare. Anecdotally, in healthcare we definitely see the "gold rush" among AI-enabled point solutions in healthcare. Still, for all the excitement, history suggests that healthcare’s winner‑take‑most dynamics are likely to see a common phenomenon play out—that being the eventual consolidation of several of these point solutions (or those offerings with the potential for commoditized status like ambient AI) into larger platforms. Whether that ends up being the EHR or some other player is the open question—but if the past is any indication, consolidation is a good bet.

Signal 2: Hospitals hit the brakes on (horizontal) M&A

While capital may have flowed freely into digital health in the last 12 months, the story was very different on the hospital M&A front as it was the slowest year for merger dealmaking in over a decade.

Three chief factors were the prime culprits deterring dealmaking:

Narrower overall margins: Across 2025, hospitals’ median margins were down once again, following a brief reprieve in 2024. The short story here is that while volume has continued to rise for many organizations, costs are once again rising and are outpacing the revenue gains.

Considerable uncertainty facing systems in in the wake of the One Big Beautiful Bill Act (OBBBA): The passage of OBBBA is expected to compress hospital operating margins by reducing coverage and lowering net reimbursement, particularly for safety-net and high‑Medicaid hospitals. Not only does OBBBA loom large, but the future likelihood of substantial outpatient shift for profitable surgeries dampens the outlook and adds further pressure to the margin picture.

Higher interest rates: The biggest reason for the downturn in healthcare M&A over the last two years has been higher interest rates, which pushed up borrowing costs and compressed valuations for both strategic acquirers and private equity sponsors. Debt became materially more expensive as the Federal Reserve lifted the federal funds rate from effectively 0% in 2021 to above 5% by late 2023. (Looking ahead, industry experts expect the Fed to move gradually into an easing cycle, with recent projections suggesting the policy rate could move toward the mid‑3% range by the end of 2026. This could contribute to M&A activity picking back up this year.)

While horizontal M&A has definitely taken a hit, it’s not like hospitals are holding back on dealmaking entirely. In their place, systems are eyeing outpatient and vertical deals that align with growth in ambulatory surgery centers (ASCs) and same‑day procedures, something that represents a significant reading of the tea leaves given CMS' recent HOPPS final rule cancellation of the IPO list that is set to phase out by January 1, 2028. As a result, some smaller systems are seeking alliances to stabilize finances and preserve access to essential services while larger systems prioritize scale, service line rationalization, and capital access. Some notable deals include:

Ascension: Signed a $3.4B deal to acquire AmSurg, expanding Ascension’s ASC portfolio from approximately 60 centers to more than 300 across 34 states.

Cleveland Clinic: Announced a joint venture with Regent Surgical to further develop Cleveland Clinic’s outpatient and ambulatory surgery offerings.

Tenet Healthcare: Continued expansion of its ASC footprint through United Surgical Partners International (USPI), the ASC arm of Tenet Healthcare, bringing its total to 556 facilities nationwide in 2025.

What’s next?

The elimination of the IPO-only list likely means that non‑hospital surgical volumes will continue to grow over the next decade. The business model incentive is clear: migrate where volume and margin still exist. We’ll be watching to see at what rate procedures accelerate their departure from traditional inpatient.

Signal 3: Physician deals hit a six-year low among most buyers

Much like hospital M&A, physician practice dealmaking also softened, with 2025 marking a six‑year low in transaction volume.

The slowdown of dealmaking has not stopped the decade-long shift toward physician employment. (Remember, as of 2024, more than three quarters of physicians are employed, and over half of all practices are owned.) The motivations of physicians for seeking employment/ownership are simple—physicians continue to seek greater resourcing and stability; namely administrative support, negotiating leverage, better access to technology, and support for value-based care (VBC) initiatives. On the buy side, the motivations behind physician acquisition (to build relationships with physicians and influence the flow of revenue) also haven’t shifted much in the last ten years, although they do of course vary by owner:

Hospitals/Health systems: Strengthen referral networks, increase outpatient revenue, and better coordinate care across the system.

Insurers: Diversify revenue streams, control more of the care pathway, and feed growth to other business lines (insurance, PBM, etc.).

Private equity: Drive efficiency, maximize profit, and quickly achieve a financial return.

But in 2025, health systems, insurers, and PE buyers all slowed acquisitions amid scrutiny and tighter returns.

The one notable exception? Drug distributors, who moved aggressively into specialty physician management. Cencora’s $4.4B stake in Retina Consultants of America, McKesson’s $2.5B buy‑in to Core Ventures, and Cardinal Health’s acquisition of Solaris Health’s urology platform show a clear thematic play—capture buy‑and‑bill drug margins across the full treatment chain.

PE’s pullback, meanwhile, reflects both market fatigue and reputational risk. As of 2024, there were more corporate-owned practices than hospital-owned practices, with 30% of practices owned by corporate entities. The pace of corporate acquisition grew steadily throughout the late 2010s, and accelerated in the immediate wake of the pandemic, but has slowed in the past couple of years, especially among PE firms. This slowdown has occurred alongside growing backlash against the “corporatization of medicine,” with critics lamenting that it puts physician autonomy at risk and pointing toward evidence that corporate-owned practices increase overall costs and hurt quality of care. PE firms have been particularly susceptible to this backlash, attracting more regulatory scrutiny in recent years. For example, in 2025, at least seven states introduced laws that aim to curb PE activity in healthcare. Economic uncertainty, reimbursement challenges (especially around MA), and a dwindling number of attractive targets within the "usual suspect" specialties (i.e. dermatology, GI, ophthalmology) have also played a role in the slowdown.

What’s next?

While extended hold periods and rising regulatory scrutiny have slowed exits, the most recent data available tells us that secondary buyouts (selling to larger PE funds) remain the most common exit strategy, with 97% of practices sold to another PE firm between 2016 and 2020.

But that model isn’t sustainable forever, as secondary buyouts:

Necessitate aggressive growth over short horizons: New PE owners will expect investments to generate higher future returns and be liquidated within the life of the fund—that gets harder to do each time over.

Typically result in sales from lower market firms to higher market firms: There are only so many larger firms before we will eventually reach a cap.

Result in diminished financial incentives for physician owners: The original deal structures that rewarded staying—such as equity stakes, retention bonuses, and favorable compensation agreements—often expire or lose value when the PE firm sells to a new owner.

With PE firms face under increasing pressure to deliver returns, we could see a resurgence of deal activity in 2026—and a possibly a new story about exit strategies.

What’s next for healthcare investment in 2026?

Healthcare investment activity in 2025 signals renewed vigor in 2026. The clear winner of 2025 was digital health (specifically AI), while health systems and physician groups were slower to rebound.

We’ll be spending more time discussing these topics across 2026 as part of our State of Healthcare research. If you’d like to gain access to that work as it’s released across the year, click here to learn more about Union’s research agenda.

Comments